ABOUT

STATS (Systematic Tactical Approach Towards Selling options) Investments is a Registered Investment Advisor (RIA, pending registration) firm dedicated to delivering high probability, risk managed alpha-centric solutions to both institutions and individuals. We are an asset management company that uses option-based strategies designed to reduce risk, diversify, and increase yield within your investment portfolio.

APPROACH

INVESTMENT PHILOSOPHY

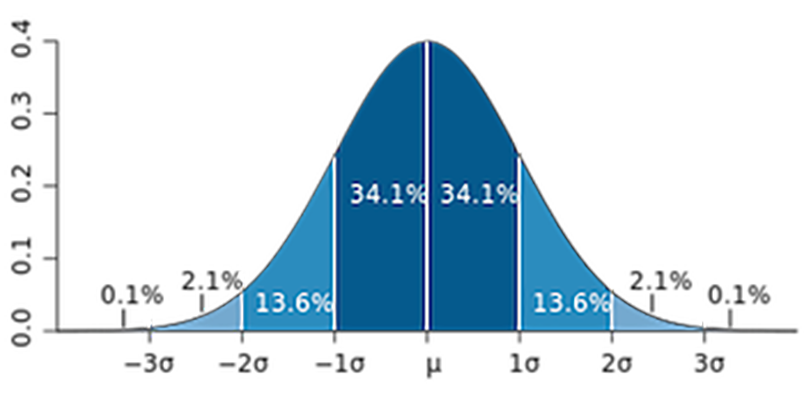

As our name indicates, we believe in the power of statistics to improve investment results. Hence, we don’t believe in picking a market direction or picking stocks. Instead, we’re always striving to “beat average.” Relative to benchmarks, outcomes are more important than performance and a systematic, tactical approach for selling options allows us to execute this philosophy.

INVESTMENT SOLUTIONS

The STATS Investments’ strategies are designed to complement a portfolio of benchmark-type stock and bond assets by providing targeted absolute returns in all market environments. In the current post-crisis, low yield, and high volatility environment, these strategies provide enhanced income through a risk-managed approach in the liquid alternatives space.

TARGETED RETURNS

In both Bull and Bear markets, we strive to deliver absolute returns as well as outperformance with better risk-adjusted return and drawdown than traditional and alternative investments.

OPTIMIZED UPSIDE MANAGEMENT

We take advantage of fear of uncertainty to capture higher premiums with our proprietary SigmaAlert™ quantitative performance trigger to indicate opportune times to enter markets.

DAILY LIQUIDITY AND TRANSPARENCY

We implement our strategies with liquid options and futures in separately managed accounts that provide daily liquidity and transparency in your investment portfolio.

Featured on tastytrade

STATS Investments approach is based on the tastytrade teachings: trade small, duration over direction, reduce cost basis, and take advantage of overpriced fear. Shawn Oesterreicher had the privilege of sharing his success story as a tastytrade-inspired trader when he was awarded as the next Rising Star in 2015. STATS Investments is proud to be a part of the tastytrade nation and encourages all who are interested in trading to explore this exceptional financial network. Hear Shawn’s success story by clicking on the video to the left.

PRODUCTS

STATS Investments uses volatility contraction as the basis for selecting trades. Using option selling to collect premium, STATS can create a diversified portfolio by adjusting strategies better than the “traditional” portfolio manager who adjusts the selection of stocks. All STATS Investments product focus on reducing risk and lowering the breakeven of the selected asset.

Income Strategy:

SIGMA PRO

Systematic. Logical. Consistent.

Steady and straight-forward for long-term investments.

A systematic approach to create a steady income, Sigma Pro is STATS Investments core product. It is ideal for investors who are seeking stable, consistent income using high probability strategy and is designed to reduce risk, diversify, and increase yield. Sigma Pro offers an outcome-oriented approach using proprietary models to capture monthly yield in addition to helping reach your yearly investment goals in all market environments.

Equity Strategy:

SIGMA SOLUTIONS

Attractive. Considered. Innovative.

Smart and methodical for a greater reward on your investments.

A smart and logical compliment for those who own stocks for investing long-term, Sigma Solutions is STATS Investments “Passive-plus” product. It is ideal for equity investors who want a liquid alternative to diversify their traditional active or passive equity portfolio. Sigma Solutions is designed to outperform the S&P 500 index by reducing “Cost Basis” by using mathematical probabilities. Sigma Solutions offers the ability to steadily and consistently help you reach your investing goals rather than attempting to predict the direction of the market.

Hedge Fund:

SIGMA RETURNS

Active. Creative. Opportunistic.

Aggressive and complete for absolute returns.

A “risk bucket” investment and the opposite of “status quo” with above average, absolute returns, Sigma Returns is STATS Investments most aggressive product. It is ideal for investors with a high risk appetite who are seeking aggressive growth and the highest possible returns. It is designed to take advantage of volatility contraction and contrarian investing using propriety Sigma Alert™. Sigma Returns offers an alternative asset to your traditional portfolio using options to trade actively when the most advantageous opportunities present themselves in both Bull and Bear markets.

OUR TEAM

Shawn Oesterreicher

President & Portfolio Manager

Shawn Oesterreicher, Founder, President & Portfolio Manager

Shawn Oesterreicher is a portfolio manager who applies a systematic derivatives selling strategy striving to generate returns with high probabilities with active risk management. Applying the knowledge of his 10+ year independent trading career, Shawn has extensive experience trading equities, equity options, global markets, commodities, futures, future options and exchange traded funds (ETFs).

Prior to founding STATS Investments, Shawn held multiple positions for several leading metals companies specializing in retirement accounts focusing on quantitative strategies to diversify and maintain a low correlation with equity markets.

In 2015 Shawn was selected as a Rising Star for the Tastytrade Network, the #1 ranked financial program on the internet (https:/www.tastytrde.com/tt/shows/rising-stars/episodes/meet-shawn-tastytrades-newest-rising-star-09-21-2015).

Shawn is a global tactical investment manager. Shawn graduated with a BA in Communications from the University of Colorado and has earned the Series 3, 7, and 66 designations.

TONY ASH, CFA

Investment Advisory Board

Tony Ash has 30+ years experience in investment operations, asset allocation, and investment risk management. He served as Managing Director and Chief Operating & Compliance Officer at Julex Capital Management (a start-up SEC-registered ETF strategist RIA firm) where he was responsible for developing and implementing all operational and compliance aspects of the business. Previously, he was Managing Director and Head of US Portfolio Management at Sun Life Financial where he developed and implemented investment policies, strategies, and mandates for $37 billion in all asset classes backing the insurance general account. Tony received his BA in Economics and his MBA in Investments both from Boston College.

QUESTIONS ABOUT YOUR PORTFOLIO?

Let’s Get Started

We are here to answer any questions you may have. We look forward to hearing from you!